DEF 14A: Definitive proxy statements

Published on July 7, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant |

ý |

||||

Filed by a Party other than the Registrant |

o |

||||

| Check the appropriate box: | |||||

| o | Preliminary Proxy Statement | ||||

| o |

Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

||||

| ý | Definitive Proxy Statement |

||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material Pursuant to § 240.14a-12 | ||||

(Name of Registrant as Specified In Its Charter)

____________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box): | ||||||||

ý |

No fee required. |

|||||||

¨ |

Fee paid previously with preliminary materials. |

|||||||

¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||||||

MICROCHIP TECHNOLOGY INCORPORATED

2355 West Chandler Boulevard, Chandler, Arizona 85224-6199

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

August 19, 2025

TIME: |

9:00 a.m., Mountain Standard Time / Pacific Daylight Time | |||||||

PLACE: |

Microchip Technology Incorporated, 2355 West Chandler Boulevard, Chandler, Arizona 85224-6199 | |||||||

| PROPOSALS: | BOARD RECOMMENDS: | |||||||

(1) |

The election of each of Ellen L. Barker, Rick Cassidy, Matthew W. Chapman, Victor Peng, Karen M. Rapp and Steve Sanghi to our Board of Directors to serve for the ensuing year and until their successors are elected and qualified. |

FOR each director nominee

|

||||||

(2) |

To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of Microchip for the fiscal year ending March 31, 2026. |

FOR | ||||||

(3) |

To hold an advisory (non-binding) vote regarding the compensation of our named executives. |

FOR | ||||||

(4) |

To transact such other business as may properly come before the 2025 Annual Meeting or any adjournment(s) or postponement(s) thereof. |

|||||||

RECORD DATE: |

Holders of Microchip common stock of record at the close of business on June 20, 2025 are entitled to vote at the 2025 Annual Meeting. |

|||||||

INTERNET AVAILABILITY OF PROXY MATERIALS: |

On or about July 7, 2025, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the "Notice") containing instructions on how to access both the proxy statement and our annual report. The Notice will also contain instructions on how to vote online or by telephone and how to receive a paper copy of the proxy materials by mail. This proxy statement and our annual report can be accessed at the following internet address: https://ir.microchip.com/sec-filings. To vote, all you have to do is go to www.proxyvote.com and enter the control number located in the Notice or on your proxy card. |

|||||||

PROXY: |

It is important that your shares be represented and voted at the annual meeting. Whether or not you expect to attend the annual meeting in person, please vote your shares as promptly as possible, or via the internet or telephone as instructed in the Notice or on your proxy card, in order to ensure your representation at the annual meeting. You can revoke your proxy at any time prior to its exercise at the annual meeting by following the instructions in the accompanying proxy statement. | |||||||

/s/ Kim van Herk | ||

|

Kim van Herk

Corporate Secretary

| ||

HOW TO ATTEND:

Stockholders may attend in person at Microchip Technology Incorporated headquarters located at 2355 West Chandler Boulevard, Chandler, Arizona 85224-6199 or listen to the webcast by visiting https://ir.microchip.com. Please note that you will not be able to ask any questions or vote via the webcast.

HOW TO VOTE:

Your vote is important! Thank you in advance for participating in our 2025 Annual Meeting.

We have elected to provide access to our proxy materials on the internet. Accordingly, we are mailing a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders of record as of June 20, 2025, containing instructions on how to access both the proxy materials for our 2025 Annual Meeting and our annual report. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice, or to request a printed set of the proxy materials. You can find instructions on how to request a printed copy by mail in the below section entitled "Proxies and Voting Procedures." This information is largely about voting procedure. You should read this entire proxy statement carefully for additional information about proposals on which we encourage you to vote. On or about July 7, 2025, we will begin mailing the Notice to all stockholders entitled to vote at the 2025 Annual Meeting. Stockholders will be able to access our proxy materials via the internet beginning on or about the same date. We intend to mail this proxy statement, together with the form of proxy to those stockholders entitled to vote at the 2025 Annual Meeting who have properly requested copies of such materials by mail.

The Microchip Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the fiscal year ended March 31, 2025 are available at https://ir.microchip.com/sec-filings.

Chandler, Arizona

July 7, 2025

Letter from Your Chair of the Board, CEO and President

In fiscal year 2025, Microchip Technology navigated the extended pandemic-induced semiconductor cycle that affected our entire industry. As your returning CEO, I want to address both our performance and highlight the decisive actions we are taking to restore Microchip to its leadership position in the semiconductor industry. These actions we are taking have already started to have a positive impact as we pursue our long-term targets which are expected to provide substantial upside and significant shareholder value.

A Year of Significant Challenges

This past year has presented significant challenges for our company. We experienced multi-year lows across key financial metrics, including revenue, gross margins, operating margins, and cash flow generation. Our balance sheet faced pressure, with our net debt to adjusted EBITDA ratio approaching the covenant limit in our credit facility. We responded proactively by restructuring our credit facility, securing covenant relief, and reducing debt through a mandatory preferred convertible stock offering, maintaining our financial flexibility.

The semiconductor industry faced extraordinary supply chain disruptions as a result of the pandemic which led to product shortages. Many customers reacted to these conditions by placing large orders to be shipped in future periods to satisfy expected future demand. When the overall market subsequently declined, these actions resulted in elevated inventory levels throughout our customer base. By mid-fiscal 2025, our inventory was growing at an unsustainable pace, creating significant pressure on our working capital and cash flow generation.

Decisive Action for Sustainable Recovery

Since returning as CEO in November 2024, I implemented a comprehensive 9-point strategic plan to directly address these challenges. This plan included necessary measures such as closing our Tempe Fab 2 wafer fabrication facility and reducing our workforce by approximately 10% in our first broad-based layoff since 2002. Under this plan, we took decisive actions to strengthen our balance sheet, reduce our leverage and maintain our investment grade debt rating while providing greater financial flexibility.

Our 9-point Strategic Plan focuses on these key areas:

•Manufacturing Excellence and Cost Structure – We have taken actions to optimize our global manufacturing footprint and reduce operating expenses while maintaining our ability to rapidly scale production when demand returns

•Working Capital Optimization – We are aggressively pursuing inventory reduction, with plans to reduce our inventory by $350 million by the end of fiscal year 2026, liberating significant cash

•Strategic Portfolio and Business Unit Realignment – We have refocused our innovation investments on high-growth megatrends, particularly Artificial Intelligence and expanded Network and Connectivity solutions, while restructuring business units to optimize resource allocation and eliminate redundancies

•Customer and Channel Strengthening – We have been proactive in repairing strained customer relationships and have achieved preferred/approved status with many of our clients where our relationship had deteriorated, and we optimized our distribution strategy to align with industry best practices

•Long-Term Business Model – We unveiled our updated non-GAAP long-term business model targeting 65% gross margins, 40% operating margins, and operating expenses at 25% of revenue – demonstrating significant upside potential as we navigate through the next upcycle

We are beginning to see early, encouraging signs that our initiatives are having a positive impact. We believe that these decisive actions position Microchip well to deliver on our long-term business model as market conditions improve, creating sustainable value for our shareholders through the next semiconductor upcycle.

2025 Proxy Statement |

1 |

|

||||||

Innovation and Market Position

Despite the challenging environment, we have maintained our focus on strategic innovation investments that we believe position Microchip for substantial future growth:

Total System Solutions (TSS): We have expanded our TSS approach beyond our traditional anchor products (MPU32, MCUs, FPGAs, and networking solutions) with the introduction of two new and innovative platform technologies:

•Our PIC64 product family was launched with advanced microprocessors and is expanding to include 64-bit MCUs to address diverse markets from industrial and automotive to aerospace and defense

•Our 10BASE-T1S Ethernet solutions were the first-to-market and such solutions are positioned to capture emerging applications across industrial automation, automotive, and defense

AI and Connectivity Megatrends: We have strategically realigned our product portfolio to capitalize on some of the industry's highest-growth segments:

•We have positioned our solutions at the intersection of major technology megatrends, where growth is significantly outpacing our core business

•Our embedded AI/ML capabilities across MCU/MPU/FPGA platforms target rapidly expanding applications with large addressable markets

•Our expanded connectivity solutions address the growing demand for Ethernet beyond traditional datacenters

Board Member Nominees and Refreshment

Each of our 2025 Board nominees brings extensive experience and their own perspectives to Board discussions. In February 2024, we added Ellen L. Barker to our Board, in February 2025, we added Victor Peng and in May 2025, we added Rick Cassidy, each of whom has significant executive-level experience in the technology industry.

In November 2024, the Board appointed Matthew Chapman as lead independent director. Mr. Chapman continues to serve as the chair of our Audit Committee. In May 2025, the Board appointed Karen Rapp as the chair of our Compensation Committee and Ellen Barker as the chair of our Nominating, Governance, and Sustainability Committee.

Looking Forward

The semiconductor industry has always been cyclical, and our 35-year history has proven our resilience through multiple downturns. Our disciplined financial management includes reducing channel inventory.

By implementing our strategic plan, right-sizing operations, continuing product innovation, and restoring financial strength, we believe we are positioning Microchip for sustainable, profitable growth. At the same time, our Board is committed to maintaining our quarterly dividend which we believe reflects our confidence in Microchip's long-term prospects and our commitment to delivering shareholder value.

I want to express my gratitude to our employees for their dedication during this challenging period, to our customers for their continued partnership, and to you, our shareholders, for your trust and support. Together, we will navigate through this downturn and emerge as a stronger, more resilient Microchip Technology.

Thank you for your continued support of Microchip.

|

Steve Sanghi, Chair of the Board, CEO and President |

||||

2025 Proxy Statement |

2 |

|

||||||

Cautionary Statement Regarding Forward-Looking Statements

This letter and our proxy statement contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "anticipates," "estimates," "expects," "projects," "forecasts," "intends," "plans," "will," "believes" and words and terms of similar substance used in connection with any discussion identify forward-looking statements. Our forward looking statements include statements regarding our actions which are expected to provide substantial upside and significant shareholder value, our plans to reduce our inventory by $350 million by the end of fiscal year 2026, our updated non-GAAP long-term business model, that our decisive actions position Microchip well to deliver on our long-term business model as market conditions improve, creating sustainable value for our shareholders through the next semiconductor upcycle, our belief that we are positioning Microchip for sustainable, profitable growth and our commitment to maintaining our quarterly dividend, our confidence in Microchip's long-term prospects and our commitment to delivering shareholder value. These forward-looking statements are based on management’s current expectations and beliefs about future events and are inherently susceptible to uncertainty and changes in circumstances. Except as required by law, Microchip is under no obligation to, and expressly disclaims any obligation to, update or alter any forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise. Various factors could adversely affect Microchip’s operations, business or financial results in the future and cause Microchip’s actual results to differ materially from those contained in the forward-looking statements, including those factors discussed in detail in the "Risk Factors" sections contained in Microchip’s filings on Form 10-K and Form 10-Q filed with the Securities and Exchange Commission (the "SEC").

2025 Proxy Statement |

3 |

|

||||||

MICROCHIP TECHNOLOGY AT A GLANCE

|

$4.40 Billion Net Sales in Fiscal Year 2025 |

|||||||

|

19,400 Employees |

|||||||

|

109,000 Customers |

|||||||

|

Headquartered Near Phoenix in Chandler, Arizona |

|||||||

MARKET MEGATRENDS

The market megatrends for Microchip are Edge Computing/IoT, Data Centers, AI/ML, Sustainability, E-Mobility and Networking/Connectivity. These megatrends are shaping the human experience. They impact how people work, learn, communicate, travel and transact and they are transforming how products are created and manufactured, moved through the supply chain, and monitored and controlled anywhere in the world. We believe that focusing on these megatrends will give us faster organic growth and improve the human experience.

| ||

2025 Proxy Statement |

4 |

|

||||||

OUR VALUES AND STRATEGIC FRAMEWORK

Our Purpose, Vision, Mission Statement and Guiding Values were designed to work together to promote a shared culture across Microchip. This strategic framework guides our employees in daily decision making. Below are the key drivers of our actions, which guide how we collaborate to serve our stakeholders and serve as the metrics against which our results are measured.

| ||

2025 Proxy Statement |

5 |

|

||||||

CORPORATE GOVERNANCE HIGHLIGHTS

Board Composition

Our Nominating, Governance, and Sustainability Committee periodically reviews the overall composition of the Board and our committees to assess whether they reflect the appropriate mix of skills, experience, backgrounds and qualifications that are relevant to Microchip’s current and future global business and strategy.

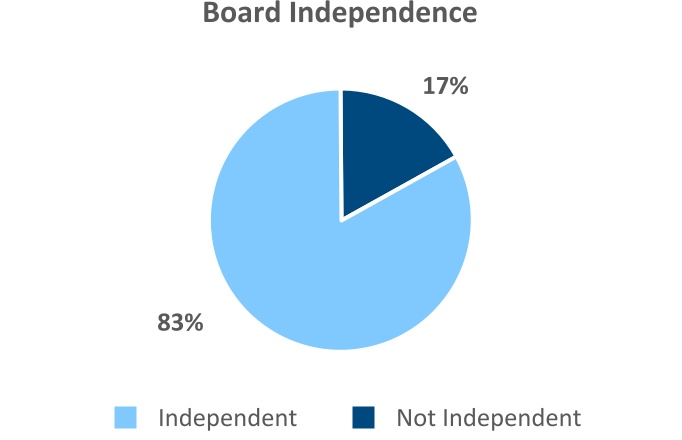

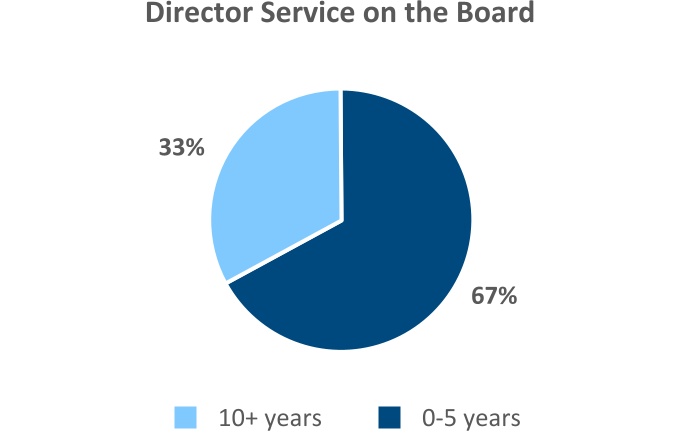

Board Profile and Refreshment

We have a proactive Board refreshment program, with four of our six Board nominees having joined Microchip since our 2020 annual meeting, and our nominees having an average tenure of 11.6 years. In reviewing nominees, the Board considers the qualifications needed and strives to maintain a balance of skills, experience, continuity and a broad range of perspectives. The following graphs highlight the composition of our Board nominees.

2025 Proxy Statement |

6 |

|

||||||

CORPORATE GOVERNANCE PRACTICES

We find it important that we have strong Board leadership, strategy setting, and sound management practices. Highlights of our governance practices include:

|

Accountability

•Annual election of all directors

•Majority voting in uncontested director elections

•Lead independent director

•Annual Board and committee self-evaluation

•Annual Say-on-Pay vote

•Anti-hedging, anti-short sale and anti-pledging policies

•Stock ownership requirement for directors, officers and other senior employees

|

Shareholder Rights

•Proxy access

•No shareholder rights plan

•No dual class share structure

•No Board members are over-boarded

•Board succession planning and refreshment

•CEO and executive officer succession planning

•At least 75% of Board members must be independent

•Periodic reviews of committee charters, code of business conduct and ethics, and corporate governance guidelines

•The Audit Committee is responsible for overseeing cybersecurity matters, while the Nominating, Governance, and Sustainability Committee oversees issues related to sustainability, environmental concerns, and human capital.

|

||||

|

Compensation Practices

•Emphasis on performance-based metrics

| |||||

COMPENSATION DISCUSSION AND ANALYSIS HIGHLIGHTS

Compensation Policies and Practices

Our commitment to designing an executive compensation program that is consistent with responsible financial and risk management is reflected in the following policies and practices:

| What We Do | What We Don’t Do | ||||

| Compensation Committee is comprised 100% of independent directors | No repricing of stock options | ||||

| Balance short and long-term incentives, cash and equity and fixed and variable pay elements | No dividends or dividend equivalents on unearned awards | ||||

| Performance-based awards are approximately 50% of the quarterly evergreen RSU grants to executive officers | No pledging or hedging of Microchip securities | ||||

| Require one-year minimum vesting for awards granted under the Amended and Restated 2004 Equity Incentive Plan, subject to certain exceptions | No perquisites or excessive severance benefits | ||||

| Solicit an annual advisory vote on executive compensation | No executive pension plans or company contribution to supplemental retirement plans | ||||

| Maintain stock ownership guidelines | No dual class stock. All of our common stock is voting. | ||||

Incentive Program – Pay-for-Performance Highlights

As described more fully in the "Executive Compensation — Compensation Discussion and Analysis" section of this proxy statement, our named executive officers are compensated in a manner consistent with our performance-based pay philosophy and corporate governance best practices.

2025 Proxy Statement |

7 |

|

||||||

| TABLE OF CONTENTS | |||||||||||

2025 Proxy Statement |

8 |

|

||||||

MICROCHIP TECHNOLOGY INCORPORATED

2355 West Chandler Boulevard

Chandler, Arizona 85224-6199

PROXY STATEMENT

You are cordially invited to attend our annual meeting on Tuesday, August 19, 2025, beginning at 9:00 a.m., Mountain Standard Time / Pacific Daylight Time. The annual meeting will be held at our Chandler facility located at 2355 West Chandler Boulevard, Chandler, Arizona 85224-6199. Stockholders may attend the meeting in person or listen to the webcast by visiting https://ir.microchip.com. You will not have the ability to ask questions or vote through the webcast.

We are providing these proxy materials in connection with the solicitation by the Board of Directors (the "Board") of Microchip Technology Incorporated ("Microchip") of proxies to be voted at Microchip's 2025 Annual Meeting of Stockholders and at any adjournment(s) or postponement(s) thereof.

Our fiscal year begins on April 1 and ends on March 31. References in this proxy statement to fiscal 2025 refer to the 12-month period from April 1, 2024 through March 31, 2025; references to fiscal 2024 refer to the 12-month period from April 1, 2023 through March 31, 2024; references to fiscal 2023 refer to the 12-month period from April 1, 2022 through March 31, 2023; references to fiscal 2022 refer to the 12-month period from April 1, 2021 through March 31, 2022; and references to fiscal 2021 refer to the 12-month period from April 1, 2020 through March 31, 2021.

We anticipate first mailing the Notice on July 7, 2025 to holders of record of Microchip's common stock at the close of business on June 20, 2025 (the "Record Date"). Our principal executive offices are located at 2355 West Chandler Boulevard, Chandler, Arizona 85224-6199.

PROXIES AND VOTING PROCEDURES

YOUR VOTE IS IMPORTANT. Stockholders may have a choice of voting over the internet, by using a toll-free telephone number or by completing a proxy card and mailing it in the postage-paid envelope provided, if applicable. Please refer to the Notice, your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you. Under Delaware law, stockholders may submit proxies electronically. Please be aware that if you vote over the internet, you may incur costs such as telephone and internet access charges for which you will be responsible.

The method by which you vote will in no way limit your right to vote at the annual meeting if you later decide to attend in person. If your shares are held in the name of a bank, broker or other holder of record (referred to in this proxy statement as "street name stockholders"), you must obtain a proxy, executed in your favor, from the holder of record, to be able to vote at the annual meeting. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

You can revoke your proxy at any time before it is exercised by timely delivery of a properly executed, later-dated proxy (including an internet or telephone vote if these options are available to you) or by voting by ballot at the annual meeting. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

All shares entitled to vote and represented by properly completed proxies received prior to the annual meeting and not revoked will be voted at the annual meeting in accordance with the instructions on such proxies. IF YOU DO NOT INDICATE HOW YOUR SHARES SHOULD BE VOTED ON A MATTER, THE SHARES REPRESENTED BY YOUR PROPERLY COMPLETED PROXY WILL BE VOTED AS OUR BOARD RECOMMENDS.

If any other matters are properly presented at the annual meeting for consideration, including, among other things, consideration of a motion to adjourn the annual meeting to another time or place, the persons named as proxies and acting

2025 Proxy Statement |

9 |

|

||||||

thereunder will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. At the date this proxy statement went to press, we did not anticipate that any other matters would be raised at the annual meeting.

Stockholders Entitled to Vote

Stockholders of record of our common stock at the close of business on the Record Date, June 20, 2025, are entitled to notice of and to vote at the annual meeting. Each share is entitled to one vote on each of the six director nominees and one vote on each other matter properly brought before the annual meeting. On the Record Date, there were 539,674,554 shares of our common stock issued and outstanding.

In accordance with Delaware law, a list of stockholders entitled to vote at the annual meeting will be available for examination by any stockholder beginning ten days prior to the annual meeting at 2355 West Chandler Boulevard, Chandler, Arizona, on any business day between the hours of 10:00 a.m. and 4:30 p.m., Mountain Standard Time / Pacific Daylight Time. If you would like to view the list, please contact our Corporate Secretary to schedule an appointment by calling (480) 792-4039 or writing to her at the address of our principal executive offices indicated above.

Notice of Availability of Proxy Materials

As permitted under the rules of the SEC, we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the internet. On or about July 7, 2025, we will begin mailing to our stockholders the Notice that contains instructions on how to access our proxy materials on the internet, how to vote at the annual meeting, and how to request printed copies of the proxy materials and annual report. You may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage you to access our proxy materials online, as this helps us lower costs and minimize the environmental impact of providing these materials to you.

Required Vote

Quorum, Abstentions and Broker "Non-Votes"

The presence, in person, or by proxy, of the holders of a majority of the shares entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. Abstentions and broker "non-votes" are counted as present and entitled to vote for purposes of determining a quorum. A broker "non-vote" occurs when a nominee holding shares for a beneficial owner (i.e., in "street name") does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Under the rules of the New York Stock Exchange ("NYSE"), which apply to NYSE member brokers trading in non-NYSE stock, brokers have discretionary authority to vote shares on certain routine matters if customer instructions are not provided. Proposal Two to be considered at the annual meeting is expected to be treated as a routine matter. Consequently, if you do not return a proxy card, your broker will have discretion to vote your shares on such matter.

Election of Directors (Proposal One)

A nominee for director shall be elected to the Board of Directors if the votes cast for such nominee's election exceed the votes cast against such nominee's election. For this purpose, votes cast shall exclude abstentions, withheld votes or broker "non-votes" with respect to that director's election. Notwithstanding the immediately preceding sentence, in the event of a contested election of directors, directors shall be elected by the vote of a plurality of the votes cast. A contested election shall mean any election of directors in which the number of candidates for election as director exceeds the number of directors to be elected. If directors are to be elected by a plurality of the votes cast, stockholders shall not be permitted to vote against a nominee.

Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal Two)

The affirmative vote of the holders of a majority of the votes cast affirmatively or negatively at the annual meeting is required for ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of Microchip for the fiscal year ending March 31, 2026. Abstentions and broker "non-votes" are not counted as votes cast affirmatively or negatively for purposes of approving this proposal, and thus will not affect the outcome of the voting on this proposal. Because this is a routine matter, we do not expect any broker "non-votes."

2025 Proxy Statement |

10 |

|

||||||

Advisory Vote Regarding the Compensation of our Named Executives (Proposal Three)

The affirmative vote of the holders of a majority of the votes cast affirmatively or negatively at the annual meeting is required to approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the rules of the SEC. Abstentions and broker "non-votes" are not counted as votes cast affirmatively or negatively for purposes of approving this proposal, and thus will not affect the outcome of the voting on this proposal.

Electronic Access to Proxy Statement and Annual Report

This proxy statement and our fiscal 2025 Annual Report are available from the SEC at its website at www.sec.gov and on our website at https://ir.microchip.com/sec-filings.

We will post our future proxy statements and annual reports on Form 10-K on our website as soon as reasonably practicable after they are electronically filed with the SEC. All such filings on our website are available free of charge. The information on our website is not incorporated into this proxy statement. Our internet address is www.microchip.com.

Cost of Proxy Solicitation

Microchip will pay its costs of soliciting proxies. Proxies may be solicited on behalf of Microchip by its directors, officers or employees in person or by telephone, facsimile or other electronic means. We may also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of Microchip common stock.

2025 Proxy Statement |

11 |

|

||||||

THE BOARD OF DIRECTORS

Corporate Governance Guidelines

Microchip’s Board has adopted a set of Corporate Governance Guidelines. The Nominating, Governance, and Sustainability Committee reviews the guidelines periodically and recommends changes to the Board as appropriate. The Board oversees administration and interpretation of, and compliance with, the guidelines.

These guidelines, which are published on our website at https://ir.microchip.com/governance/governance-documents, along with our other corporate governance practices, compare favorably under the Investor Stewardship Group’s ("ISG") Corporate Governance Framework for U.S. Listed Companies, as shown in the table below.

| ISG Principle | Microchip Practice | ||||

|

Principle 1

Boards are accountable to stockholders.

|

•All directors are elected annually

•Majority voting in uncontested director election

•No shareholder rights plan

•Proxy access with market terms (3% for three years, up to the greater of two directors or 20% of the Board)

•Chair of the Board, CEO and President’s letter in proxy statement highlights our Board’s activities over the past year

|

||||

|

Principle 2

Stockholders should be entitled to voting rights in proportion to their economic interest.

|

•No dual-class share structure

•Each stockholder is entitled to one vote per share of common stock

|

||||

|

Principle 3

Boards should be responsive to stockholders and be proactive in order to understand their perspectives.

|

•We regularly meet with our institutional stockholders, focusing on actively managed funds through non-deal roadshows, conferences, bus tours and individual meetings. In fiscal 2025, we met with fund managers representing approximately 56.5% of our actively managed common shares outstanding.

•Engagement topics included strategy, financial and operational matters; culture; ESG matters; executive compensation; and corporate governance.

•The Board, in response to investor feedback, has proactively refreshed its Board membership since January 2021 to provide a range of perspectives and industry experience with four of our six Board nominees having joined Microchip since our 2020 annual meeting.

|

||||

|

Principle 4

Boards should have a strong, independent leadership structure.

|

•Lead independent director appointed

•Board considers appropriateness of its leadership structure at least annually

•Independent committee chairs

•Independent directors meet in executive session at least four times per year

•Non-employee directors may only serve on the Board for 17 years after June 1, 2024

|

||||

2025 Proxy Statement |

12 |

|

||||||

|

Principle 5

Boards should adopt structures and practices that enhance their effectiveness.

|

•83% of the director nominees are independent

•We require that three-fourths of our directors be independent

•We prioritize and actively seek individuals with varied backgrounds, experiences, and skills during each Board search

•Annual Board and committee evaluations

•Active Board refreshment, with four of our six Board nominees having joined Microchip since our 2020 annual meeting, and having an average tenure of 11.6 years

•Limits on outside boards, with no independent director permitted to serve on more than four public company boards (including Microchip), and no management director permitted to serve on more than three public company boards (including Microchip). Board members are required to seek approval of the Board Chair and Nominating, Governance, and Sustainability Committee Chair before undertaking additional outside public directorships. This policy is contained in our Corporate Governance Guidelines. We regularly review compliance with this policy and, as of March 31, 2025, all of our directors were in compliance.

•No restrictions on directors’ access to senior management

|

||||

|

Principle 6

Boards should develop management incentive structures that are aligned with the long-term strategy of the company.

|

•Compensation Committee reviews and approves incentive program design, goals, and objectives for alignment with compensation and business strategies

•Annual and long-term incentive programs are designed to reward financial and operational performance that furthers short- and long-term strategic objectives

|

||||

Meetings of the Board

Our Board met 17 times in fiscal 2025. All of our directors attended 100% of the total number of meetings of the Board held during such time as such person was a director during fiscal 2025, except that one director missed one meeting and one director missed two meetings. Our various Board committees met a total of 32 times in fiscal 2025. All of our directors attended 100% of the total number of meetings held by all of the committees of the Board on which they served during fiscal 2025 during such time as such person was a director and served on such applicable committee. The Board has a practice of meeting in executive session on a periodic basis without management or management directors (i.e., Mr. Sanghi) present. In May 2025, the Board determined that each of Ms. Barker, Mr. Cassidy, Mr. Chapman, Mr. Johnson, Mr. Peng and Ms. Rapp is an independent director as defined by applicable SEC rules and Nasdaq listing standards.

Board Leadership Structure

The Board believes that Mr. Sanghi is best situated to serve as Chair of the Board because he has served as our Chief Executive Officer and/or President for over 30 years and is the director with the most experience with Microchip's business and industry. As our current Chief Executive Officer and President, Mr. Sanghi identifies strategic priorities and leads the discussion and execution of strategy with input from the other members of the Board. The Board's independent directors have different perspectives and roles in strategic development. In particular, Microchip's independent directors bring experience, oversight and expertise from outside the company and the industry, while Mr. Sanghi brings company-specific experience and industry expertise. The Board believes that the role of the Chair facilitates information flow between management and the Board, which is essential to effective governance.

Board Commitments

To ensure that our directors can devote appropriate time to Microchip matters and as a matter of good governance, our Board of Directors maintains limits on the number of public company boards on which a Microchip director can serve.

2025 Proxy Statement |

13 |

|

||||||

Our policy is contained in our Corporate Governance Guidelines and states that a director should not serve on more than four publicly traded companies’ boards (including Microchip’s Board) or, if the Director is serving as an executive officer of Microchip, no more than three publicly traded companies’ boards (including Microchip’s Board). The Chair of the Nominating, Governance and Sustainability Committee and our Lead Independent Director review compliance with this policy and, as of March 31, 2025, all of our directors were in compliance.

Lead Independent Director

The Board appointed Matthew W. Chapman to serve as lead independent director in November 2024. The appointment of a lead independent director is required under our Corporate Governance Guidelines in the event the Chair of the Board is not an independent director. The Lead Independent Director has the following responsibilities: (i) to review Board meeting agendas in advance of each meeting and Board meeting schedules to ensure sufficient time for discussion of agenda items, (ii) to consult and collaborate with the non-independent Chair as appropriate, (iii) chair any executive sessions of the Board which occur outside the presence of the non-independent Chair, the CEO and any other members of management then serving on the Board, (iv) to call meetings of independent directors at any time they deem appropriate, (v) to chair Board meetings if the non-independent Chair is not present, (vi) to retain outside advisors in connection with the performance of these duties as they deem appropriate, and (vii) to perform such other duties as the Board may deem appropriate from time to time.

Board and Committee Oversight of Risk Management and Sustainability

The Board and the Board committees oversee risk management in a number of ways. The Audit Committee oversees the management of financial and accounting related risks as an integral part of its duties. Similarly, the Compensation Committee considers risk management when setting the compensation policies and programs for Microchip's executive officers. As part of this process, our Compensation Committee concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on Microchip. The Board periodically assesses the programs and initiatives that support the environment, social, health, safety, innovation and technology objectives of our business.

The Board or the Audit Committee regularly receive reports on various risk-related items, including risks related to manufacturing operations, cybersecurity, IT system continuity, taxes, intellectual property, litigation or other proceedings, products and personnel matters. The Board or the Audit Committee also receive periodic reports on Microchip's efforts to manage and mitigate such risks through safety measures, system improvements, insurance or self-insurance. The Board considers the various risks related to our business and discusses such risk areas and risk mitigation actions with our management team. The Board believes that the leadership structure described above facilitates the Board's oversight of risk management because it allows the Board, working through its committees, to participate actively in the oversight of management's actions.

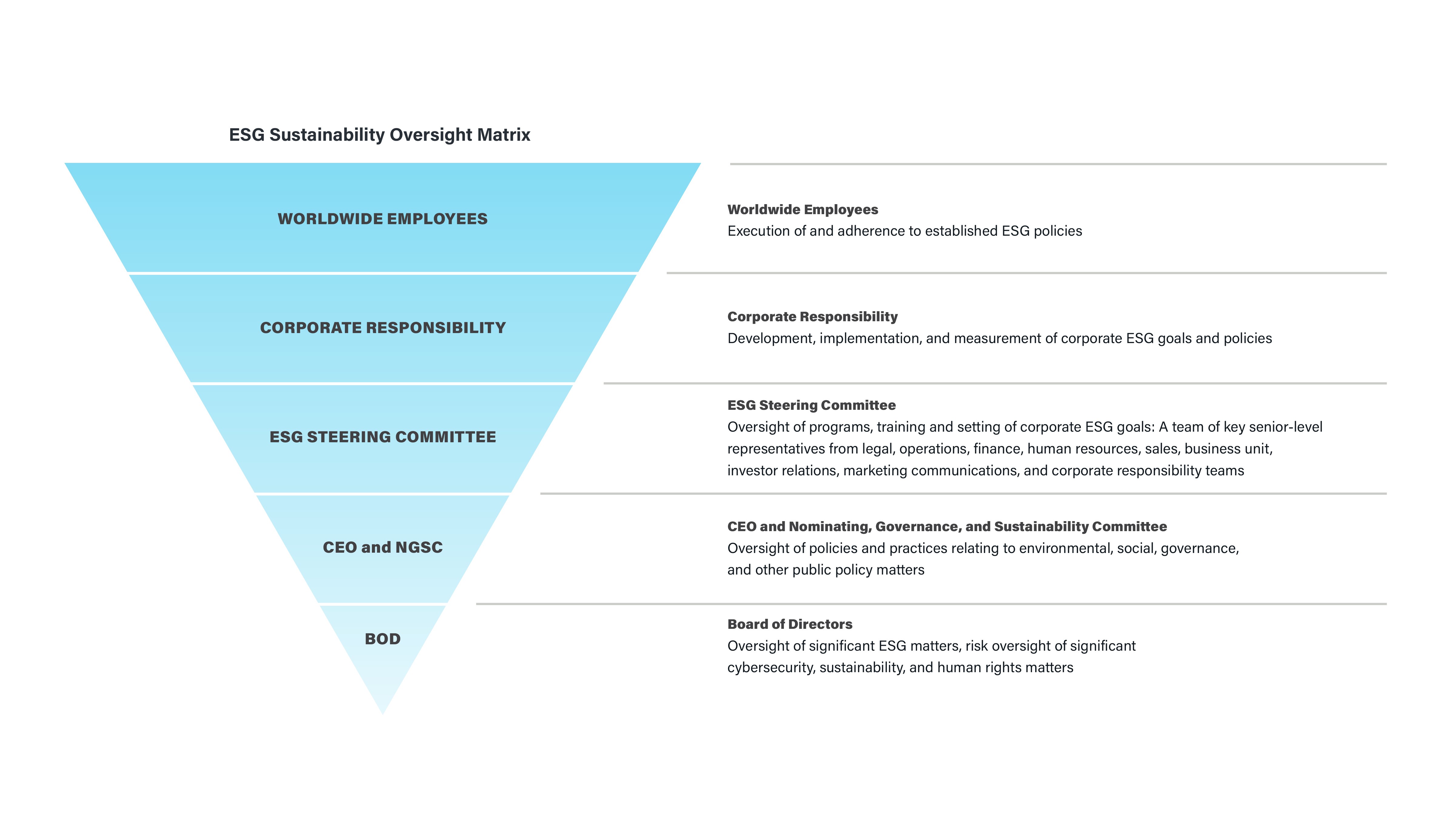

The Board and the Nominating, Governance, and Sustainability Committee, with the assistance of our ESG Steering Committee, oversee our policies and practices relating to sustainability, social responsibility and other public policy matters relevant to Microchip. The ESG Steering Committee reviews and reports to the President and CEO, Nominating, Governance, and Sustainability Committee and Board, and discusses with management, matters of corporate responsibility and sustainability performance, potential long and short-term trends and impacts to our business of environmental, social, human capital and governance issues, including our public reporting on these topics.

Our corporate ESG Steering Committee is comprised of executives and senior managers from various disciplines such as compliance, finance, human resources, legal, operations, sales, and technology. The ESG Steering Committee oversees the activities of the Corporate Responsibility team which is accountable for the development, implementation and measurement of Microchip’s corporate ESG goals and policies.

Sustainability Approach

The five tenets of our ESG strategy include: (1) Our Company; (2) Our Planet; (3) Our Supply Chain; (4) Our Products; and (5) Our People. In fiscal 2025, the ESG Steering Committee focused on our sustainability programs related to environmental sustainability, supply chain transparency and combatting forced labor. The committee's review included specific topics such as environmental target tracking, Water Risk Assessment and Forced Labor and Human Rights. We performed an assessment of key indicators and engaged with our internal and external stakeholders to prioritize our ESG strategy.

2025 Proxy Statement |

14 |

|

||||||

Microchip's commitment to being a responsible corporate citizen is shared by our board members, executive management team and employees. Our employee-empowered approach enables everyone to feel included in our sustainability journey and contribute to its future success. Our Nominating, Governance, and Sustainability Committee and Board of Directors have ultimate oversight over all significant ESG matters.

| ||

Protecting our Environment with a Focus on Sustainability

We believe that sustainability projects support robust efficient operations while lowering costs and addressing the expectations of our stakeholders. Our commitment to the environment goes beyond our compliance with regulatory obligations at our global facilities. We have climate targets aligned with climate science, and we invest in green business practices. In calendar 2024, we engaged in efforts to reduce our carbon footprint, energy consumption, water usage, wastewater discharge, and waste generation. The following focus areas are reported in our most recent Sustainability Report:

Emissions - We reduced GHG emissions in 2024. We had a third-party auditor conduct an ISO 14064-compliant limited assurance audit of our Scope 1 and Scope 2 emissions. In addition, we expanded our Scope 3 emissions tracking and reporting.

Energy - By upgrading equipment, lighting, and HVAC systems, we reduced our energy consumption since 2018. To further reduce our Scope 2 carbon emissions, we executed multiple renewable energy contracts in 2024.

Water/Wastewater - We have continued to reduce our water use through investments in water conservation and reclamation projects at our manufacturing facilities. We continued implementing tailored mitigation strategies at certain sites in 2024 in response to the water risk assessment we conducted in 2023.

Waste - Microchip has successfully executed multiple circularity initiatives in partnership with its waste management partners to sustainably dispose of waste streams generated from our operations, thereby diverting toxic waste from landfills. In calendar year 2024, we continued to divert waste away from our communities’ landfills, wastewater treatment sites, and the atmosphere.

Sustainable Products - We recognize the impact and significance of our products in enabling future climate solutions and therefore strive to manufacture low power consumption and environmentally-preferable products. We aim to use sustainable materials and manufacturing processes where possible. In 2024, we expanded our portfolio of low-power semiconductors that support energy-efficient infrastructure, renewable energy systems, and electric mobility applications.

For more information, please see our latest Sustainability Report (which covers calendar year 2024) at: https://www.microchip.com/en-us/about/corporate-responsibility.

2025 Proxy Statement |

15 |

|

||||||

Human Capital and Culture

Addressing Human Rights Risks in the Workplace

We are committed to being a responsible corporate citizen and acting ethically and transparently in accordance with local, national and international laws and regulations and industry standards. Our commitment to social responsibility includes requiring our suppliers to respect human rights principles, health and safety, and to ethically address conflict minerals and the environment. In fiscal 2023, we published our Supplier Code of Conduct, which is aligned with our Vision, Mission Statement, and Guiding Values. Our Supplier Code of Conduct supports Microchip’s Code of Business Conduct and Ethics. In April 2022, we first published our Human Rights Policy which covers ethical business conduct, employee rights and fair labor practices, anti-harassment, safety in the workplace, our commitment against forced labor, human trafficking and child labor, and our respect for freedom of association. Our Human Rights Policy is available at https://www.microchip.com/en-us/about/corporate-responsibility. Our supply chain partners are expected to follow our Human Rights Policy and our Supplier Code of Conduct which is modeled after that of the Responsible Business Alliance ("RBA"), a nonprofit organization comprised of companies committed to supporting the rights and well-being of workers and communities worldwide affected by the global supply chain.

At our Annual Meeting of Stockholders held on August 20, 2019, our stockholders approved a proposal for our Board to report on our processes for identifying and analyzing potential and actual human rights risks to workers in our operations and our supply chain. We published reports from 2021 through 2025. A copy of our most recent report is available at https://www.microchip.com/en-us/about/corporate-responsibility. As part of our assessment of these risks, in 2020, we aligned our Supplier Code of Conduct to the terms of the RBA Code of Conduct (version 7.0), which includes elements specific to preventing forced labor, such as requiring:

•employment be freely chosen by the employee;

•no workers under the age of 15, or the minimum age of the country, whichever is greater;

•wages and benefits comply with all applicable wage laws;

•no harsh and inhumane treatment including any sexual harassment, sexual abuse, corporal punishment, mental or physical coercion or verbal abuse of workers; and

•workplaces free of harassment and unlawful discrimination.

As part of our continued process improvements, in 2021 and 2023, we conducted onsite audits through independent auditors at three of our four non-US manufacturing facilities pursuant to RBA's Validated Assessment Program. In 2023 and 2024, we enhanced our supply chain review process on the topic of forced labor risks. Please see our latest Sustainability Report and our Report Regarding Ethical Recruitment and Forced Labor for more details regarding such matters.

Culture and Core Values

Over 30 years ago, Microchip created a cultural framework to unite its employees through shared workplace values, and to guide employees’ strategies, decisions, actions and job performance. Microchip’s culture has been centered on a values-based, highly-empowered, continuous-improvement oriented approach. At the core of our culture are employee empowerment, teamwork, collaboration, and communication, with the goal of driving engagement, and inspiring creativity and innovation. Today, this corporate culture continues to strengthen all aspects of our business and enables us to fulfill our purpose.

Microchip’s Guiding Values convey our overall philosophy, and are the basis from which we make our day-to-day decisions, and continue to cultivate our corporate culture. Our focus on communication provides transparency among leadership, promotes trust among employees, and is a critical part of Microchip’s culture.

Compensation Programs

Microchip has competitive compensation programs which include equity components that allow employees to participate in our success. Eligible employees receive restricted stock units ("RSUs") at hiring and annually under various equity plans. Our employee stock purchase plans allow eligible employees an opportunity to purchase our common stock at a discount.

Please see the "Executive Compensation - Compensation Discussion and Analysis" section of this proxy statement for more detailed information regarding our compensation philosophy and programs.

2025 Proxy Statement |

16 |

|

||||||

Non-Discrimination and Equal Opportunity Employment

We believe employees of all backgrounds contribute to our ongoing success. It is important that we do not discriminate and that we support the needs of our employees. We design jobs and provide opportunities promoting employee teamwork, productivity, creativity, pride in work, trust, integrity, fairness, involvement, development, and empowerment. Employees receive recognition, promotions, and pay increases based on outstanding performance at the company, team, and individual levels. We foster our employees’ health and welfare by offering competitive and comprehensive employee benefits. All managers, supervisors and employees are responsible for maintaining a work environment that is free from discrimination and harassment, and for promptly reporting violations. Our policy on Non-Discrimination and Equal Opportunity Employment is available at https://www.microchip.com/en-us/about/corporate-responsibility.

Microchip provides equal employment opportunities and treats all applicants with respect. In the U.S., Microchip operates in compliance with EEO guidelines for recruitment and hiring practices. Regular and updated training is provided to recruiters as well as hiring managers to ensure understanding of hiring practices. Multiple recruiting sources are utilized by Microchip, including: our company career site, university job boards, Direct Employers, our Employment Service Delivery System (the system that posts jobs to state job boards and other agencies), Microchip social media postings, and attendance at many university and veteran career fairs and events.

Audit Committee Oversight of Information Security

Information security is the responsibility of our Information Security team, overseen by our Vice President, Chief Information Security Officer. We leverage a combination of the best practice standards of the National Institute of Standards and Technology Cybersecurity Framework and the International Organization for Standardization and Center for Internet Security to measure security posture, deliver risk management, and provide effective security controls. Our information security practices include development, implementation, and improvement of policies and procedures to safeguard information and help ensure availability of critical data and systems. Our Information Security team conducts information security awareness training for all employees with access to our computer systems. Our Audit Committee, comprised fully of independent directors, is responsible for oversight of cybersecurity and information security risk. Our Chief Information Security Officer delivers quarterly reports and updates to the Audit Committee, and our full Board is typically in attendance at these presentations, which include a wide range of topics including trends in cyber threats, and the status of initiatives designed to bolster our security systems. For more information, see Item 1c of our most recently filed Annual Report on Form 10-K for the fiscal year ended March 31, 2025.

Communications from Stockholders

Stockholders may communicate with the Board or individual members of the Board by writing to the attention of the Corporate Secretary at Microchip Technology Incorporated, 2355 West Chandler Boulevard, Chandler, Arizona 85224-6199, who will then forward such communication to the appropriate director or directors.

2025 Proxy Statement |

17 |

|

||||||

Committees of the Board

The following table lists our three standing Board committees, the directors who served on them at March 31, 2025, and the number of committee meetings held in fiscal 2025:

MEMBERSHIP ON BOARD COMMITTEES IN FISCAL 2025

|

Name

|

Audit

|

Compensation

|

Nominating, Governance and Sustainability |

||||||||||||||

| Ellen L. Barker | • | • | |||||||||||||||

Rick Cassidy(1)

|

|||||||||||||||||

| Matthew W. Chapman | C | ||||||||||||||||

Karlton D. Johnson(2)

|

• | C | |||||||||||||||

Wade F. Meyercord(3)

|

|||||||||||||||||

Victor Peng(4)

|

|||||||||||||||||

Robert A. Rango(5)

|

• | • | |||||||||||||||

| Karen M. Rapp | • | C | |||||||||||||||

Ganesh Moorthy(6)

|

|||||||||||||||||

| Steve Sanghi | |||||||||||||||||

Meetings held in fiscal 2025 |

8 | 14 | 10 | ||||||||||||||

C = Chair

• = Member

(1)Mr. Cassidy was elected to our Board on May 2, 2025 and was appointed to the Compensation Committee and the Nominating, Governance, and Sustainability Committee on May 20, 2025.

(2)Mr. Johnson served as the Chair of our Nominating, Governance, and Sustainability Committee and was on our Audit Committee during fiscal 2025 until he stepped down from the Board on May 20, 2025.

(3)Mr. Meyercord served as the Chair of our Compensation Committee and was on our Nominating, Governance, and Sustainability Committee during fiscal 2025 until his retirement from the Board on August 20, 2024.

(4)Mr. Peng was elected to our Board on February 10, 2025 and was appointed to the Compensation Committee and the Nominating, Governance, and Sustainability Committee on May 20, 2025.

(5)Mr. Rango served on our Compensation Committee and on our Nominating, Governance, and Sustainability Committee during fiscal 2025 until his retirement from the Board on February 19, 2025.

(6)Mr. Moorthy served on our Board during fiscal 2025 until his retirement on November 18, 2024.

Audit Committee

The responsibilities of our Audit Committee are to appoint, compensate, retain and oversee Microchip's independent registered public accounting firm, oversee the accounting and financial reporting processes of Microchip and audits of its financial statements, and provide the Board with the results of such monitoring. These responsibilities are further described in the committee charter which was amended and restated as of May 21, 2024. A copy of the Audit Committee charter is available at https://ir.microchip.com/governance/governance-documents.

In May 2025, our Board determined that all members of the Audit Committee are independent directors as defined by applicable SEC rules and Nasdaq listing standards. The Board has also determined that each of Mr. Chapman and Ms. Rapp meet the requirements for being an "audit committee financial expert" as defined by applicable SEC rules, and Mr. Meyercord met the requirements for being an "audit committee financial expert" as defined by applicable SEC rules while he served on the Audit Committee.

In fiscal 2005, our Board and our Audit Committee adopted a policy with respect to (i) the receipt, retention and treatment of complaints received by us regarding questionable accounting, internal accounting controls or auditing matters; (ii) the confidential, anonymous submission by our employees of concerns regarding questionable accounting, internal accounting controls or auditing matters; and (iii) the prohibition of harassment, discrimination or retaliation arising from submitting concerns regarding questionable accounting, internal accounting controls or auditing matters or participating in an investigation regarding questionable accounting, internal accounting controls or auditing matters. In fiscal 2012, our Board and our Audit Committee approved an amended policy to include matters regarding violations of federal or state securities laws, or the commission of bribery. This policy, called "Reporting Legal Non-Compliance," was created in accordance with

2025 Proxy Statement |

18 |

|

||||||

applicable SEC rules and Nasdaq listing requirements. A copy of this policy is available at https://ir.microchip.com/governance/governance-documents.

Compensation Committee

Our Compensation Committee makes compensation decisions regarding our executive officers and administers our equity incentive and employee stock purchase plans adopted by our Board. The responsibilities of our Compensation Committee are further described in the committee charter which was amended and restated as of May 21, 2024. The committee charter is available at https://ir.microchip.com/governance/governance-documents.

In May 2025, the Board determined that all members of our Compensation Committee are independent directors as defined by applicable SEC rules, Nasdaq listing standards and other requirements. For more information on our Compensation Committee, please refer to the "Executive Compensation - Compensation Discussion and Analysis" at page 34.

Nominating, Governance, and Sustainability Committee

Our Nominating, Governance, and Sustainability Committee has the responsibility to help ensure that our Board is properly constituted to meet its fiduciary obligations to our stockholders and Microchip and that we have and follow appropriate governance standards. In so doing, the Nominating, Governance, and Sustainability Committee identifies and recommends director candidates, develops and recommends governance principles, and recommends director nominees to serve on committees of the Board. The responsibilities of our Nominating, Governance, and Sustainability Committee are further described in the committee charter, as amended as of May 21, 2024, which is available at https://ir.microchip.com/governance/governance-documents.

Our Nominating, Governance, and Sustainability Committee also oversees our policies and practices relating to ESG and other public policy matters relevant to Microchip. In this regard, the committee reviews and reports to the Board, and discusses with management, on a periodic basis, matters of corporate responsibility and sustainability performance, including potential long and short-term trends and impacts to our business of environmental, social, human capital, and governance issues, including our public reporting on these topics.

In May 2025, the Board determined that all members of the Nominating, Governance, and Sustainability Committee are independent directors as defined by applicable SEC rules and Nasdaq listing standards.

When considering a candidate for a director position, the Nominating, Governance, and Sustainability Committee looks for demonstrated character, judgment, relevant business, functional and industry experience, and a high degree of skill. The Nominating, Governance, and Sustainability Committee believes it is important that the members of the Board represent a broad range of viewpoints. Accordingly, the Nominating, Governance, and Sustainability Committee considers a variety of factors in identifying and evaluating director nominees, including differences in education, professional experience, viewpoints, technical skills, individual expertise, ethnicity and personal background. The Nominating, Governance, and Sustainability Committee evaluates director nominees recommended by a stockholder in the same manner as it would any other nominee. The Nominating, Governance, and Sustainability Committee will consider nominees recommended by stockholders provided such recommendations are made in accordance with procedures described in this proxy statement under "Requirements and Deadlines Regarding 2026 Stockholder Proposals or Nominations" and "Other Business and Director Nominations to Be Presented at the Annual Meeting" at page 67.

Attendance at the Annual Meeting of Stockholders

All directors are encouraged, but not required, to attend our annual meeting of stockholders. All then serving directors attended our Annual Meeting of Stockholders on August 20, 2024.

2025 Proxy Statement |

19 |

|

||||||

REPORT OF THE AUDIT COMMITTEE (*)

Our Board has adopted a written charter setting out the purposes and responsibilities of the Audit Committee. The Board and the Audit Committee review and assess the adequacy of the charter on an annual basis. A copy of the Audit Committee Charter is available at https://ir.microchip.com/governance/governance-documents.

Each of the directors who serves on the Audit Committee meets the independence and experience requirements of the SEC rules and Nasdaq listing standards. This means that the Microchip Board has determined that no member of the Audit Committee has a relationship with Microchip that may interfere with such member's independence from Microchip and its management, and that all members have the required knowledge and experience to perform their duties as committee members.

We have received from Ernst & Young LLP the written disclosure and the letter required by Rule 3526 of the Public Company Accounting Oversight Board ("PCAOB") (Communication with Audit Committees Concerning Independence) and have discussed with Ernst & Young LLP their independence from Microchip. We also discussed with Ernst & Young LLP all matters required to be discussed by PCAOB standards and the applicable requirements of the SEC. We have considered whether and determined that the provision of the non-audit services rendered to us by Ernst & Young LLP during fiscal 2025 was compatible with maintaining the independence of Ernst & Young LLP.

We have reviewed and discussed with management the audited annual financial statements included in Microchip's Annual Report on Form 10-K for the fiscal year ended March 31, 2025 and filed with the SEC, as well as the unaudited financial statements filed with Microchip's quarterly reports on Form 10-Q. We also met with both management and Ernst & Young LLP to discuss those financial statements.

Based on these reviews and discussions, we recommended to the Board that Microchip's audited financial statements be included in Microchip's Annual Report on Form 10-K for the fiscal year ended March 31, 2025 for filing with the SEC.

By the Audit Committee of the Board:

Matthew W. Chapman (Chair) |

Karlton D. Johnson** |

Karen M. Rapp |

||||||||||||

________________________

(*) The Report of the Audit Committee is not "soliciting" material and is not deemed "filed" with the SEC, and is not incorporated by reference into any filings of Microchip under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date of this proxy statement and irrespective of any general incorporation language contained in such filings.

(**) Mr. Johnson stepped down from the Board on May 20, 2025.

2025 Proxy Statement |

20 |

|

||||||

Director Compensation

Procedures Regarding Director Compensation

The Board, including executive officers serving on the Board, sets non-employee director compensation. Microchip does not pay employee directors for services provided as a member of the Board of Directors. Our program of cash and equity compensation for non-employee directors is designed to achieve the following goals: compensation should fairly pay directors for work required for a company of Microchip's size and scope; compensation should align directors' interests with the long-term interests of stockholders; compensation should be competitive so as to attract and retain qualified non-employee directors; and the structure of the compensation should be simple, transparent and easy for stockholders to understand. Non-employee director compensation is typically reviewed once per year to assess whether any adjustment is needed to further such goals. In fiscal 2024, the Compensation Committee considered input from an independent consultant when considering non-employee director compensation matters.

Director Fees

During fiscal 2025, non-employee directors received an annual retainer of $100,000, paid in quarterly installments. Directors do not receive any additional compensation for telephonic meetings of the Board, or for meetings of committees of the Board. Our Lead Independent Director receives an additional annual fee of $30,000, paid in quarterly installments for their service in that role and the non-employee Chairs of Audit Committee, Compensation Committee and Nominating, Governance, and Sustainability Committee receives additional annual fees of $30,000, $20,000 and $10,000 respectively, paid in quarterly installments, for their service in that role. If our Board Chair is a non-employee director, such director will receive an additional annual fee of $50,000, paid in quarterly installments.

Our non-employee directors agreed to reduce the foregoing non-employee director fee payments by 20% effective February 19, 2024 in connection with other expense reduction actions taken by our management team in light of weak business conditions. Consistent with the continued weak macroeconomic environment, the reduction in director fees continued until March 31, 2025 at which time the directors were reimbursed for the reduced fees.

Equity Compensation

During fiscal 2025, under the terms of our 2004 Equity Incentive Plan, on the date of our annual meeting of stockholders, each non-employee director is automatically granted that number of RSUs equal to $200,000 divided by the fair market value of a share of our common stock on the grant date, which RSUs shall vest in full on the earlier of (i) one day prior to the next annual meeting of stockholders, or (ii) one year from the date of grant. When a non-employee director is first appointed to the Board, the number of RSUs to be granted to such new director shall be pro-rated to reflect the portion of the year that the new director served on the Board.

All vesting of the above grants is contingent upon the non-employee director maintaining his or her continued status as a non-employee director through the applicable vesting date. In the event a non-employee director retires or elects not to stand for reelection, the vesting of any RSUs that would vest within one year of the date that such director notifies the Board of his or her decision to retire or not stand for reelection would be accelerated.

In accordance with the foregoing, on August 20, 2024, each of Mr. Chapman, Ms. Barker, Mr. Johnson, Mr. Rango and Ms. Rapp were granted 2,491 RSUs, Mr. Peng received an initial grant of 2,010 RSUs when he joined the Board on February 10, 2025 and Mr. Cassidy received an initial grant of 1,258 RSUs when he joined the Board on May 2, 2025.

2025 Proxy Statement |

21 |

|

||||||

The following table details the total compensation for Microchip's directors for fiscal 2025:

DIRECTOR COMPENSATION

Name |

Fees Earned or Paid in Cash

($)

|

Stock Awards

($) (1)

|

Non-Equity Incentive Plan Compensation

($)

|

All Other Compensation

($)

|

Total

($)

|

||||||||||||||||||||||||

Steve Sanghi (2)

|

36,278 | — | — | — | 36,278 | ||||||||||||||||||||||||

Ganesh Moorthy (3)

|

— | — | — | — | — | ||||||||||||||||||||||||

| Ellen L. Barker | 102,308 | 195,517 | — | — | 297,825 | ||||||||||||||||||||||||

Rick Cassidy(4)

|

— | — | — | — | — | ||||||||||||||||||||||||

Matthew W. Chapman |

143,924 | 195,517 | — | — | 339,441 | ||||||||||||||||||||||||

Karlton D. Johnson(5)

|

108,449 | 195,517 | — | — | 303,966 | ||||||||||||||||||||||||

Wade F. Meyercord(6)

|

61,342 | — | — | — | 61,342 | ||||||||||||||||||||||||

Victor Peng(7)

|

13,889 | 101,041 | — | — | 114,930 | ||||||||||||||||||||||||

Robert A. Rango(8)

|

100,919 | 195,517 | — | — | 296,436 | ||||||||||||||||||||||||

| Karen M. Rapp | 118,679 | 195,517 | — | — | 314,196 | ||||||||||||||||||||||||

(1)The award of 2,491 RSUs to each of the non-employee directors on August 20, 2024 (other than Mr. Meyercord) had a fair value on the grant date of $78.49 per share and a market value on the grant date of $80.28 per share with an aggregate market value of each award of approximately $200,000.

(2)Mr. Sanghi served as a non-employee director on our Board between August 20, 2024 and November 18, 2024. During that period, Mr. Sanghi received cash compensation for his service on our Board. Mr. Sanghi did not receive any additional compensation for his service on our Board during the periods in which he served as an executive officer of Microchip.

(3)Mr. Moorthy was an executive officer of Microchip and did not receive any additional compensation for his service on our Board. Mr. Moorthy retired from the Board and as an executive officer of Microchip effective November 18, 2024.

(4)Mr. Cassidy was elected to our Board on May 2, 2025 and therefore did not receive any Board compensation during fiscal 2025.

(5)Mr. Johnson stepped down from the Board effective May 20, 2025.

(6)Mr. Meyercord retired from the Board effective August 20, 2024.

(7)The initial award of 2,010 RSUs to Mr. Peng on February 10, 2025 was prorated and had a fair value on the grant date of $50.27 per share, and a market value on the grant date of $52.05 per share, with an aggregate market value of approximately $100,000.

(8)Mr. Rango retired from the Board effective February 19, 2025.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is currently comprised of Ms. Rapp (Chair), Mr. Cassidy and Mr. Peng. Ms. Barker, Mr. Johnson, Mr. Meyercord and Mr. Rango also served on the Compensation Committee during fiscal 2025. Each such person is an independent director. None of the directors who served on the Compensation Committee during fiscal 2025 or who currently serve on the Compensation Committee, had any related-party transaction with Microchip during fiscal 2025 other than compensation for service as a director, as applicable. In addition, none of such directors has a relationship that would constitute a compensation committee interlock under applicable SEC rules. During fiscal 2025, no Microchip executive officer served on the compensation committee (or equivalent) or the board of directors of another entity whose executive officer(s) served either on Microchip's Compensation Committee or Board.

CERTAIN TRANSACTIONS

During fiscal 2025, Microchip had no related-party transactions within the meaning of applicable SEC rules.

Pursuant to its charter, the Audit Committee reviews issues involving potential conflicts of interest and reviews and approves all related-party transactions as contemplated by Nasdaq and SEC rules and regulations. The Audit Committee may consult with the Board regarding certain conflict of interest matters that do not involve a member of the Board.

2025 Proxy Statement |

22 |

|

||||||

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) and related rules under the Securities Exchange Act of 1934 require our directors, executive officers and stockholders holding more than 10% of our common stock to file reports of holdings and transactions in Microchip stock with the SEC and to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the copies of such forms received by us during fiscal 2025, and written representations from our directors and executive officers that no other reports were required, we believe that all Section 16(a) filing requirements applicable to our directors, executive officers and stockholders holding more than 10% of our common stock were met for fiscal 2025.

2025 Proxy Statement |

23 |

|

||||||

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board currently consists of six directors: Ellen L. Barker, Rick Cassidy, Matthew W. Chapman, Victor Peng, Karen M. Rapp and Steve Sanghi. Each of our six directors were nominated for re-election to the Board at the annual meeting and each of the nominated directors has agreed to continue serving if re-elected.

Unless proxy cards are otherwise marked, the persons named in the proxy card will vote such proxy for the election of the nominees named below. If any of the nominees becomes unable or declines to serve as a director at the time of the annual meeting, the persons named in the proxy card will vote such proxy for any nominee designated by the current Board to fill the vacancy. We do not expect that any of the nominees will be unable or will decline to serve as a director.

The Board and the Nominating, Governance, and Sustainability Committee have carefully considered the experience, structure, culture, operation, interactions, collaboration and performance of the current Board; the talents, expertise and contributions of individual directors; the growth and creation of stockholder value under the Board's leadership; the continued evolution of Microchip; the Board's role in continuing to develop and lead the strategic direction of Microchip; the continued change and consolidation in the semiconductor industry; anticipated future challenges and opportunities facing Microchip; and the Board's ongoing commitment to ensuring the long-term sustainability of Microchip to the benefit of its stockholders.

Our Board has determined that each of the following nominees for director is an independent director as defined by applicable SEC rules and Nasdaq listing standards: Ms. Barker, Mr. Cassidy, Mr. Chapman, Mr. Peng and Ms. Rapp.

The term of office of each person who is elected as a director at the annual meeting will continue until the 2026 Annual Meeting of Stockholders and until a successor has been elected and qualified.

Vote Required; Board Recommendation

A nominee for director in an uncontested election shall be elected to the Board if the votes cast for such nominee's election exceed the votes cast against such nominee's election (with votes cast excluding abstentions, withheld votes or broker "non-votes").

The Board and the Nominating, Governance, and Sustainability Committee believe that fostering continuity on the Board by nominating all six of our current directors for re-appointment is instrumental to the ongoing execution of our mission and strategy, as well as to the delivery of sustainable long-term value to our stockholders.

Our Board desires a mix of background and experience among its members. Our Board does not follow any ratio or formula to determine the appropriate mix. Rather, it uses its judgment to identify nominees whose backgrounds, attributes and experiences, taken as a whole, will contribute to the high standards of board service at Microchip. Maintaining a balance of tenure among the directors is also part of the Board's consideration. The effectiveness of the Board's approach to Board composition decisions is evidenced by the directors' participation in the insightful and robust, yet respectful, deliberation that occurs at Board and Board committee meetings, and in shaping the agendas for those meetings.

Our Board and executive management are dedicated to creating an environment where a variety of perspectives are valued and considered. Each Board member contributes unique experiences and viewpoints to our discussions. In addition to a range of backgrounds and experiences, we also recognize the importance of other unique attributes that directors may bring, including military service. We are proud to have a military veteran currently serving on our Board.

2025 Proxy Statement |

24 |

|

||||||

Based on these considerations, among others, the Board unanimously recommends that stockholders vote "FOR" the nominees listed below.

|

Key Experience Highlights:

•November 2024 to Present - Chair of the Board, CEO and President, Microchip Technology Incorporated

•1993 to November 2024 - Chair of the Board of Directors, Microchip Technology Incorporated

•1991 to 2021 - CEO, Microchip Technology Incorporated

•1990 to 2016 - President, Microchip Technology Incorporated

Membership on Other Public Boards:

•2024 to Present - Intel Corporation, Board Member

•2021 to Present - Impinj, Inc., Board Chair

•2018 to 2020 - Mellanox Technologies Ltd.

Education:

•M.S. in Electrical and Computer Engineering from the University of Massachusetts

•B.S. in Electronics and Communication from Punjab University

|

||||

|

Steve Sanghi

Chair of the Board

Age: 69 years old

Director Since: August 1990

| |||||